Chinese online marketplace, Alibaba.com, says it expects to attract about 500 businesses from across Canada to a Toronto marketing event this September, although British Columbia’s salmon exporters don’t seem too interested.

“(B.C. growers) already sell directly to China, and I don’t believe they use Alibaba,” an industry source that advises dozens of salmon farmers told SalmonBusiness. B.C. fish farmers do fine without the Chinese online service, and exports to China in 2016 reached a record 1,200 tonnes.

Yet, the allure of Alibaba has been real elsewhere in Canada’s “food chain”. An Alibaba purchasers’ web page for orders of Norwegian and Canadian salmon stipulates orders of “a minimum 10 tonnes”. Yet, while an Alibaba promo for Chinese New Year, 2014, helped a Prince Edward Island lobsterman sell 90,000 lobsters in 24 hours, no other major seafood-export windfalls like the lobster story have been reported since.

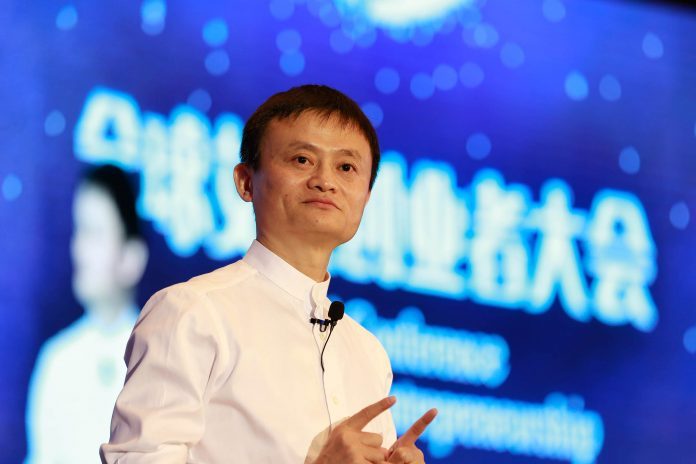

The B.C. salmon-industry source said her outfit wasn’t going to the one-day Toronto event called Gateway ’17 Canada, a travelling roadshow led by Alibaba founder, Jack Ma. An earlier Gateway event in Detroit drew delegates from small businesses across the U.S., excited about instant expansion via contact with China’s 600-million-strong middle class and its less-heralded fish-distribution network.

While a Gateway communique quotes Mr. Ma saying, “Fresh food is highly sought-after” by the country’s middle-incomed population, less known is the state of the country’s troubled, shrinking wild capture fishery — overfished and plagued by species bans. Chinese companies burdened by empty boats are more likely than the middle class to be the real online demand for North American and Norwegian salmon. Matching North American producers to Chinese distributors is a stated aim of the conference, although the distributors may well be extensions of Chinese seafood firms.

In a statement, Alibaba president Michael Evans (a Canadian from Toronto), called on Canadians to remember the 90,000 lobsters sold on a single day during that highly staged, single-day promo.

“Last year, China became the world’s largest retail market, with spending topping US$4.84 trillion,” Evans said in a statement. He pointed to 500 million active Alibaba users, electronic settlements … and logistics, “which ensures products are delivered seamlessly and efficiently”. Online sales worth USD500 billion make Alibaba a giant, offering sellers a “virtual mall”, “a storefront” and info on buyers.

At the Detroit event, Canadian seafood retailer, Clearwater, agreed to make the leap into China after Thai Union-owned Chicken of the Sea did the same. Alibaba stuck its head out and declared a “strategic partnership” with Chicken of the Sea. Neither are understood to be selling salmon under their new partnerships.

Alibaba brand Tmall is understood to be the online tool for companies with good brand awareness in China. An industry player quoted on Alibaba info channel, Alizila, said Tmall Global was “a long-term investment play, which requires investment into your brand and establishing a long-term presence in China.”

Who’s buying?

Almost overnight, the exporters Alibaba manages to attract will “enable” — a favourite word of Jack Ma’s — Chinese importers and, invariably, Chinese seafood companies by replacing a lost resource. Shipping from “bonded warehouses” in China, Tmall’s logistics solution has also arranged pre-sales of seafood on its pre-sale channel, yushou.tmall.com.

According to an Alibaba news channel, customers place advance orders during designated promotion periods so that farmers and fishermen know precisely what demand is, later shipping the goods within a specified time period. “Depending on the country, field-to-doorstep deliveries take place in as little as 2-3 days.”

Meanwhile, global sales of B.C. farm-raised salmon reached a record $745-million CAD in 2016. The United States took in 85 percent of B.C. salmon exports (52,000 tonnes) with just 15 percent ending up in Asia.

B.C. salmon exports to Asia grew a whopping 40 percent in 2016, to 4,700 tonnes, with China (1,240 tonnes), Japan (846 tonnes) and South Korea (1,600 tonnes) the fastest-growing markets.

This story was updated on 24 August with two minor corrections.