Company also wants to acquire small and medium-sized marine technology companies to take “advantage of the continuing growth in the salmon-farming and aquaculture industry.”

OTAQ, the marine technology products and solutions group for the global aquaculture (as well as and offshore oil and gas industries) has announced its full-year results ended 31 March on the London Stock Exchange.

In March OTAQ become a publicly listed company on the London stock exchange after a GBP 12.4 million acquisition by cash shell Hertsford Capital.

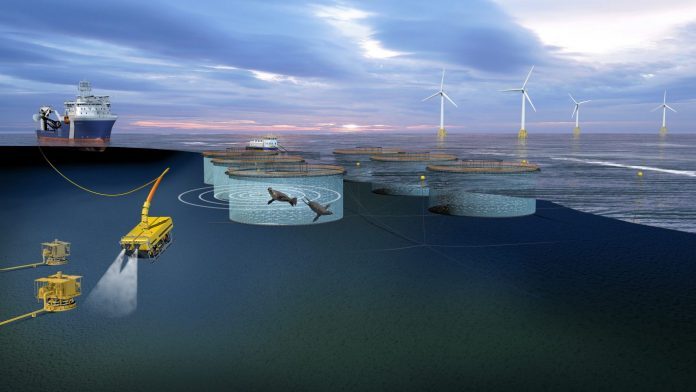

The company has 42 per-cent of the market share of predator-defence technology in Scotland through its core product, seal and sea lion deterrent system SealFence. Some of QTAQ’s clients are The Scottish Salmon Company, Mowi, Scottish Sea Farms and Multiexport Foods.

This year revenue was GBP 3.42 million, up from FY 2019’s GBP 1.58 million. It lowered its operating loss to GBP 339,000 compared to last year’s GBP 343,000.

OTAQ said that delivered on a 20 per cent increase in rental revenue for SealFence.

Non-Executive Chairman of OTAQ Alex Hambro said that the reverse takeover of Hertsford Capital placed the company “in a strong cash position which, in line with our strong revenue and margin growth, we can use to further innovate and broaden our offering across the global aquaculture sector.”

“We have still maintained business throughout the lockdown with minimal interference, as our employees were granted special dispensation to continue supplying critical products and services throughout. As we come through this period, our objectives are to continue development and contracts with SealFence, while also looking to acquire small and medium-sized marine technology companies, taking advantage of the continuing growth in the salmon-farming and aquaculture industry,” he added.