It is a stock market darling. And has been for a long time. No fish stock in the world is traded more than Mowi. The salmon industry’s undisputed market leader provides a rough supply of investors’ liquidity in this segment. Precisely the high liquidity has meant that Mowi – over time – has been traded at a premium compared to other similar companies.

The company’s market capitalization has doubled in the last five years, but 2021 was something of a respite. Mowi did significantly weaker than the total index on the Oslo Stock Exchange.

Still, the stock is not cheap.

Expected price increase

According to estimates obtained by Infront, Mowi will present a net profit per share of NOK 10.03 for 2021. With a share price of NOK 210 on Wednesday morning, this means a P/E ratio (price/earnings – editor’s note) of 20.9.

But stocks are rarely priced on past merits. Investors are looking ahead. And they are seeing increased earnings. For Mowi and other salmon stocks.

This is primarily due to a tight supply side. On Tuesday, SalmonBusiness was able to report that Kontali Analyze has halved its prospects for growth in world salmon production. Kristiansund-based advisory firm sees global supply growth of a meagre 1.6 per cent this year.

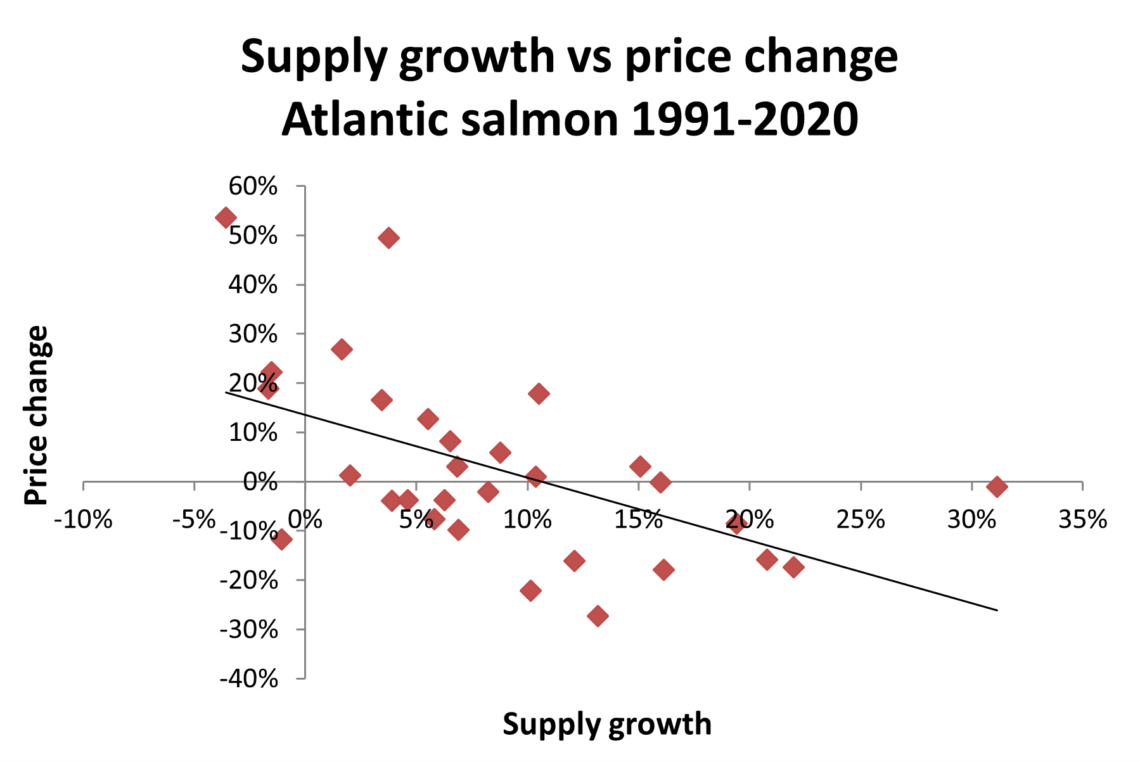

This should normally ensure increased salmon prices. At least if one relies on the historical correlation between supply growth and salmon prices. A completely marginal increase in sales volumes will usually drive up spot prices.

The catch-up has been strong in 2021, after the demanding Corona year 2020. With the reopening of the still somewhat lame HoReCa sector during the year, the salmon market will be tight, not least for those with the lowest purchasing power.

That the salmon price should add up is not a bold tip either, given the extensive inflationary wave seen in a large number of industrial sectors and raw materials.

Fish Pool’s forward curve points to a salmon price of NOK 64 (€6.40) in 2022. The investment bank’s salmon analysts must have good arguments for deviating significantly from this in their price assumptions – which is the core of their analysis and recommendations.

Dividend

According to Infront, Mowi is expected to earn NOK 12.38 and 12.83 per share in 2022 and 2023, respectively. This means a P/E of 16.9 and 16.3 in 2022 and 2023, respectively. For dividend-hungry investors, Mowi may be tempted by a dividend yield of 4.2 per cent in 2022, rising to 4.6 per cent in 2023. There is significantly more than one gets in risk-free interest rates in the bank, and in line with owner John Fredriksen’s dividend strategy.

So how can one get a quick overview of Mowi as an investment object?

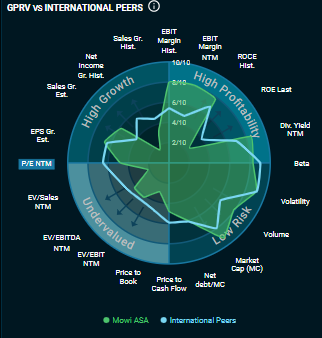

Infront has developed a graph that presents the company’s key figures. Here it appears that the company is characterized by relatively low growth, high profitability, low risk, but it can hardly be called cheap.

A profile that may otherwise be similar to several other salmon companies.

So should one buy or sell shares in Mowi?

There is a clear preponderance of buy recommendations. Of the 12 investment banks that report to Infront, seven have buy recommendations, three have neutral recommendations and two have sell recommendations. The average price target is NOK 240 (median is NOK 252). This gives an upside of 14 per cent from the price level on Wednesday morning.