With its stock in decline, Atlantic Sapphire is actively seeking additional financial support.

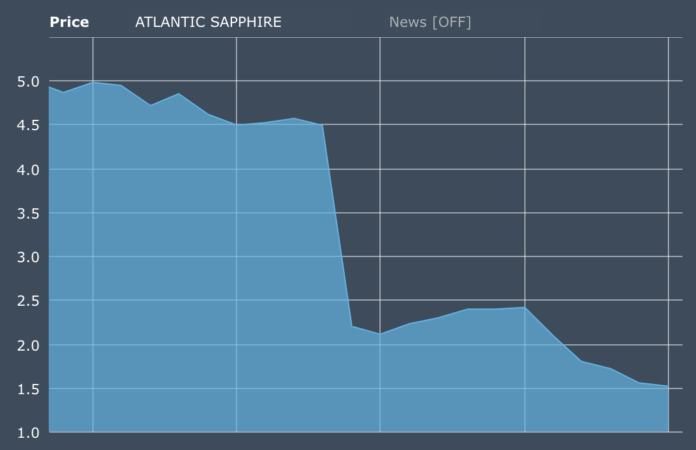

The value of land-based salmon farmer Atlantic Sapphire has fallen by 35 percent in the past week alone.

The company’s shares continue to fall following a stock exchange announcement made late in August after news broke about a potential breach of loan terms.

The decline has been continuous, with the company’s shares dropping from approximately NOK 4.5 to around NOK 2.1 on August 24.

As of Monday, the shares had declined even further, closing at approximately NOK 1.5.

Financial reports suggest that mutual funds have responded to the company’s dwindling fortunes. The DNB fund, DNB SMB, has recently liquidated a majority of its holdings in Atlantic Sapphire, according to Norwegian business newspaper DN.

This comes on the heels of last week’s disclosure by the financial daily that investment firm AS Clipper, steered by the Steensland family, divested from Atlantic Sapphire.

Read more: Shipping dynasty dumps Atlantic Sapphire in shock $4.5m bloodbath

Dag Hammer, Administrator at DNB, voiced concerns over the company’s viability.

Speaking to DN, Hammer noted, “It’s evident that land-based salmon farming at a large scale poses challenges. It’s more intricate than many anticipated.”

With its stock in decline, Atlantic Sapphire is actively seeking additional financial support.

Prominent shareholders with board representation, such as Nordlaks, EW Group, and Strawberry, have signalled their continued monetary backing should the company proceed with a financing round.