Supply and demand on tight line.

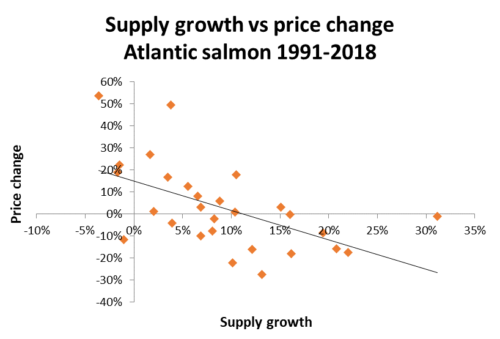

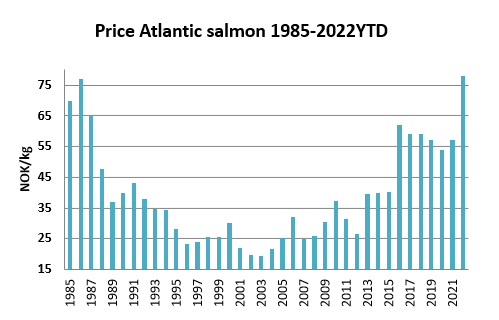

The industry is supply-driven. If there is one key figure that analysts are closely following, it is the supply growth for salmon. If the supply growth is higher than 6-8 per cent, the salmon price will fall. If the supply growth is lower than this, the salmon price will rise.

Historically, this has proven to be true. And this year, the growth in supply is expected to be negative. Less farmed salmon will most likely be sold than last year. Then the salmon price will go sky high. Which is exactly the case. Farmgate prices well into over EUR 9 have not been observed in modern times.

Shopping cart

Shopping cart

The fish farmers rub their hands. This winter’s earnings are second to none.

“The money is pouring in,” said a medium-sized salmon farmer the last time we spoke to him.

When a reduced supply meets rising demand, being on full speed out of Covid-19 hibernation, there will not be enough fish for everyone. And those who buy fish must be prepared to pay more for it.

Not unlike the big talk in the media in recent months, energy prices. Low supply and high demand.

It is basically no different from the items in the shopping cart. Copper scarcity sends prices for electronics straight up. Wheat flour, corn and frying oil will be significantly more expensive. Meat products will be much more expensive, not least due to the war in Ukraine. This (and high natural gas prices) also contributes to the fall in fertilizer production, which in turn will weaken grain crops and result in permanently high food prices.

Prices for petrol and diesel have already exceeded USD 5 per gallon in the US. Jet fuel is also becoming more expensive. Do we have to skip the summer vacation at Mallorca or shopping in New York?

Scarcity of aluminum and raw materials for batteries make cars more expensive. Should we postpone the car purchase – or rather invest in a reasonably priced used car?

As if that was not enough: Inflation will also help raise interest rates. Leveaged homeowners will soon notice the new realities.

Under pressure

Now it’s the common people’s turn. To pay much more for the goods. If they get hold of goods at all.

Purchasing power is under severe pressure.

Earlier today, SalmonBusiness reported on Korean fish buyers who have tripled their air freight costs. Restaurants, which do not get salmon, have to delete it from the menu.

It is called demand destruction.

Inflation empties the wallet. The trade unions are announcing hefty wage settlements. Which in turn will raise interest rates. It’s spiralling.

Balancing

For salmon farmers, it is noticeable that there are fewer buyers of salmon at EUR 9 than at EUR 7 per kilo. That’s the way it is. There are not enough fish for everyone. The price balances supply and demand.

The cost side is also characterized by inflation. Biologists, processing workers and salesmen need to be paid more. The steel in the work boats is becoming more expensive. Fish feed, which is the largest single component on the cost side in aquaculture, was at an all-time high at the turn of the year. After the outbreak of war in Ukraine put grain supplies under severe pressure, fish feed prices are expected to rise sharply. Costs are rising – and eating margins.

Then it remains to be seen what weighs heaviest: Is it the scarcity of supply that pushes up the price of salmon – or is it a slimmer wallet and demand destruction that carries enough weight to send it down again?