An open-hearted Gustav Witzøe talks about the past year.

At the end of the year, Gustav Witzøe’s investment company Kvarv had a total balance of NOK 36.5 billion (€3.7 billion). This includes a generous amount of shares, as well as a long-term debt of NOK 8.6 billion (€871.7 million).

“We cannot complain about an increase in turnover from NOK 20.5 billion (€2.1 billion) to NOK 22.9 billion (€2.3 billion), nor about an annual result of NOK 2.7 billion (€273.7 million), even though this was somewhat lower than the NOK 3.3 billion (€334.5 million) last year,” writes Gustav Witzøe in an exceptionally comprehensive annual report for the Kvarv group.

“We build for the future. Our income is used to create jobs, build industry and ensure a solid financial foundation for further growth. As documented in a report prepared by a group of students at the Norwegian University of Science and Technology recently: The private companies are the lifeblood of the coast, they are the ones who ensure that there is light in the houses. I am proud that Kvarv is an important part of this lighting, through the many businesses associated with the group and all our suppliers, customers and partners”.

On the salmon’s terms

“Ever since SalMar was established with a single farming concession and a few employees in a wharf at Nordskag, the company that eventually became a “group” (I don’t quite like the expression) has had its eyes fixed on a clear goal. We will build an industry based on the tastiest of all foods, the Atlantic salmon, with a solid element of processing in Norway. And the means of action must be production on the salmon’s terms, with sustainability at all stages, and so cost-effectively that we must be able to withstand all seas. Our Soria Moria has been to build a world-leading seafood company, firmly rooted on the Norwegian coast. We have managed that,” he wrote.

One transaction Witzøe is particularly proud of:

“Nonetheless, it was a historic milestone when, on Monday 30 May 2022, cooperating companies were able to send out a notification about the merger of SalMar and NRS, combined with SalMar’s offer to acquire all shares in NTS. These are some of the most well-run aquaculture companies in the world – and they all have their head office in Trøndelag. We are well on our way to establishing the world’s second largest salmon producer, and the most important industrial company north of Oslo. It makes us proud both on behalf of the companies joining together, the region and our country.”

Capital management

Kvarv’s subsidiary Kverva manages most of the group’s ownership positions in the operating companies. Kverva is one of the Nordic region’s leading seafood investors, but also invests within a wider investment universe, including asset management which is being developed. SalMar is the largest single investment, but the ownership also includes companies such as Scale Aquaculture, Pelagia, Insula, Nutrimar and BEWI.

However, Witzøe is not letting go of the opportunity to send a kick in the direction of the government’s increase in wealth tax.

“A limiting factor is the wealth tax, which only covers owners resident in Norway, and which most OECD countries have abolished. To pay this tax, the owners must take out large dividends, which are taxed separately. Layer upon layer of special Norwegian tax that comes on top of what the companies pay. In our view, wealth tax is in reality company tax, which has increased to 1.7 per cent on 75 per cent of assets. For the financial year 2021, the real wealth tax was 1.24 per cent on 55 per cent of the wealth.”

“For the owners of Kvarv, the wealth/dividend tax increases from NOK 287 million (€29 million) to NOK 535 million (€54.2 million) with the government’s budget settlement with the Socialist Party last December. This is an increase in the necessary capital withdrawal of 86 per cent”.

Taken out

He reacts in particular to the fact that the tax hits businesses regardless of whether they make a profit or not.

“Kvarv has adopted a dividend of NOK 1.25 billion (€126.6 million) – to service this wealth tax for this year and the coming years. Every kroner must be taken out of the companies’ job-creating equity capital. The adopted dividend is aimed at also meeting more demanding times for the industry – should it come – knowing that wealth and related dividend tax must be paid whether the companies make a profit or not.”

“Our clear opinion is that value creation through investments, jobs and innovation along the Norwegian coast would be significantly higher if we could manage this money in the Kvarv Group, rather than the money being confiscated in the form of a special tax on Norwegian ownership.”

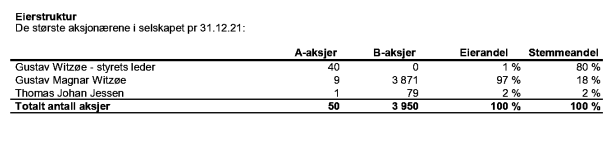

Although his son Gustav Magnar Witzøe is listed as clearly the largest owner in Kvarv, it is the father who owns 80 percent of the company’s voting A shares and thus has the real power. In addition, Kverva’s general manager, Thomas Jessen, has two percent ownership.

“Kvarv and its owners do not suffer from any ‘tax refusal’. On the contrary, we gladly pay the taxes on our business when it happens on the same terms as other industries and foreign competitors,” the annual report states.

| Qarv | 2021 | 2020 | Change |

| Turnover | 2321.8 | 2072 | 12.1% |

| EBIT | 250 | 301.5 | -17.2% |

| Result before taxes | 324.5 | 393.8 | -17.6% |

| Operating margin | 10.7% | 14.6% | |

| All figures in millions of euros | |||