Political will behind the darkest day ever for listed salmon stocks.

Forget September 11, 2001. Forget EU-imposed punitive tariffs, the ILA shock in Chile or the collapse of Lehman Brothers. 28 September 2022 will go down in history as the day where politics erased the greatest shareholder value from listed salmon shares.

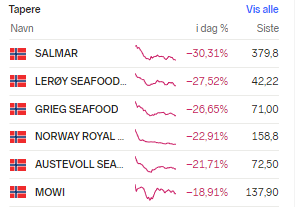

The list of losers at Oslo Børs is littered with names of big and heavy salmon farmers.

Ideological choice?

Let it be said straight away: These are not indebted companies without substance or earnings.

These are rock-solid companies, with high profitability, in markets that are crying out for their products.

And the losses are not due to accidents or market problems. No, it is due to political will. Probably an ideological choice, where one moves capital from the private to the public sector – in a big way.

When you see this in the context of the tax increases in the power industry, the whole thing looks like a light version of nationalisation. Or as Norwegian minister of finance Trygve Slagsvold Vedum so aptly said during today’s press conference: “Fish farmers can invest together with the government“.

Norwegian trade unionist Peggy Hessen Følsvik has previously promised “to take the rich”. She and the Labour Party (Ap) and the Centre Party (Sp) government succeeded today, with the proposal for a 40-percent resource rent tax sends the tax rate up to 62 percent for salmon and trout farming.

Hits the little ones

Centre Party leader and Finance Minister Vedum nevertheless consoles himself with the idea that this primarily affects the listed companies – not the smaller, privately owned farming companies.

But the minimum deduction of 4,000-5,000 tonnes applies to a very limited selection of players. The big losers are the privately-owned small and medium-sized companies that were already in limbo due to the drastic tightening of wealth tax (based on a radical increase in the valuation of concessions). Now earnings after tax are plummeting, while the prospect of selling out of the industry is much less attractive than it was yesterday.