The sushi is getting more expensive. And someone has to take it off the menu.

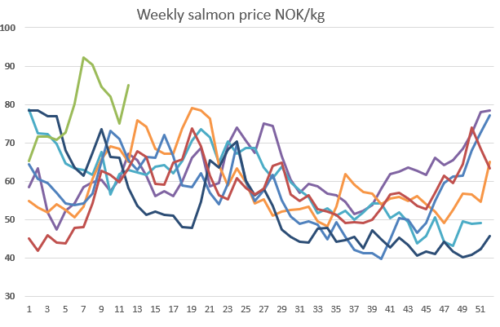

Last Friday, the price fell heavily. At that time, the salmon was largely traded between EUR 7.4-7.6 (to fish farmers). Today, prices are rising by almost one euro per kg.[factbox]

“There is talk of 85+ [NOK] (EUR 8.5). People buy almost one and one truck when needed. One buys from the need one has from what the packer can deliver. The market out there seems to be settling in an early 80-score, but still there is talk of higher as well. You do not know until you sell the fish,” a trader tells SalmonBusiness.

“For some it is quite right that they get five kroner (EUR 0.5) more than others, because they have a special fish for a special market, for example to China.”

Flight trouble

He gets support from a competitor.

“Prices are rising. Probably 5-6 kroner (EUR 0.5-0.6) up in all sizes. But not 6+ kg. There is pressure on the aviation market. 3-6 kg is around 85 (EUR 8.5) on average, I think.”

“Air freight rose in price so much that customers canelled their orders. The big salmon is the cheapest we have bought – at 80-82 kroner (EUR 8-8.2).”

“We must reduce volume since we do not have enough credit limit. A truck with salmon will soon cost two million kroner (EUR 200,000). It’s challenging. But of course there are not much fish around. That’s what makes it so. Low quantity,” he remarks.

He also notices that inflation is biting more and more.

“We pay oil surcharges for our freight. From northern Norway to Oslo, we now pay 40,000 kroner (EUR 4,000) for a truck. Two years ago we paid 20,000. We also see that in Asia a lot of salmon are taken off the menu, due to air freight.”

Little to offer

A declining biomass and ditto harvest volumes are noticeable in the market.

“There is not much fish. Lots of prodfish (production fish, low quality fish – ed. note). That is probably the reason. Little to offer,” says one exporter, and refers to average prices between 83 and 85 kroner (EUR 8.3-8.5).

Another exporter sees even higher prices.

Another exporter sees even higher prices.

“86 to 93 kroner (EUR 8.6-9.3). Wide spreads,” he says.

Stop serving

The Japanese market in particular is noticing the growing problems with air freight of fresh salmon, as a result of Russia and Ukraine being closed to commercial air traffic.

“Unfortunately, we see that we have to stop serving our popular Aurora salmon dishes,” an employee of the restaurant chain Sushi Choshimaru told the Japanese newspaper Asahi Shimbun.

He added that they need to source frozen salmon products, as it is “not possible” to fly the salmon from Norway.

Aurora Salmon is the brand of Lerøy Seafood Group.