It was in the middle of lunch on Tuesday that it became clear: Norway Royal Salmon (NRS) would merge with NTS fish farming division SalmoNor. The new fish farming grouping, with a production capacity of 124,000 tonnes, will be the world’s sixth largest salmon producer.

Read also: NRS merges with SalmoNor to form world’s sixth largest salmon producer

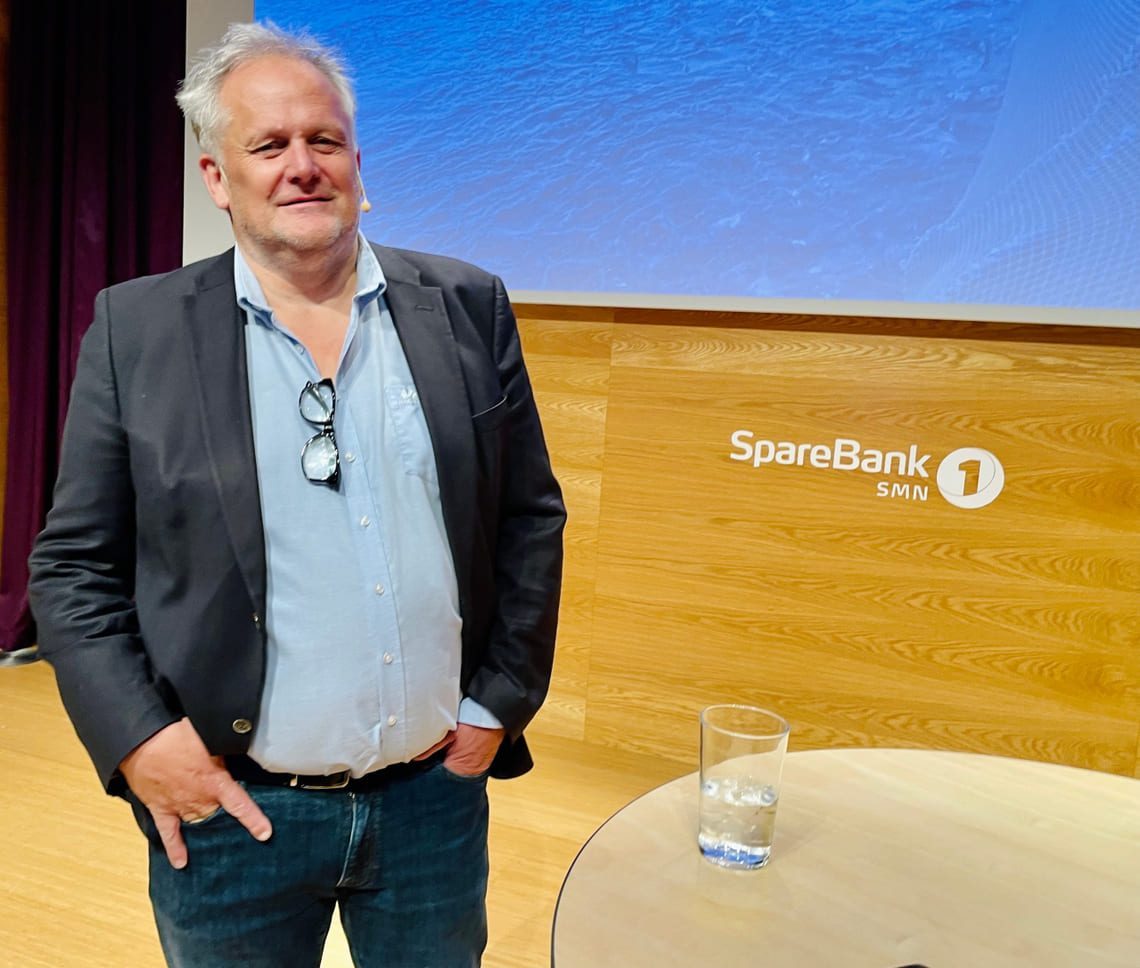

Harry Bøes, the NTS CEO, is clear in his explanation of why NTS is now merging SalmoNor and NRS. In a post on Instagram, he said the following: “We will do this here to create more jobs, we will create more food and more money.”

Fall

On the stock exchange, however, there was little indication that the latter was at the top of the agenda. The share price of NRS fell sharply, by 5.1 per cent. In comparison, NTS share price rose by 0.4 per cent after the transaction became known.

The NRS share, last trading at NOK 146 on Wednesday morning, is now at its lowest level since the spring of 2018. It is no more than five months since it was traded as high as NOK 275, during late summer’s acquisition battle when NTS strong man Helge Gåsø outmanoeuvred rival Gustav Witzøe and SalMar.

Of the purchase price of NOK 6.4 billion (€640 million) for SalmoNor, NRS will pay NOK 4.4 billion (€440 million) in shares, and – at the same time – pay NOK 2 billion (€200 million) in cash. This must be obtained through a share issue, by selling assets or raising debt.

Issue?

“NRS is listed on the stock exchange, so here the final conditions will be decided by how the price develops in the future. At the same time, it is unclear whether you will need to raise more debt. All these factors create increased uncertainty, so in my eyes it is natural that the stock falls,” said Christian Nordby, analyst at Kepler Cheuvreux, to E24.

However, a diluting share issue does not tempt Helge Gåsø to the current share price.

“Personally, I feel that the NRS price is too low. This may be due to the fact that they have been waiting for clarifications regarding ownership that have made the share less attractive,” said Helge Gåsø to E24.