Who knew what when?

The rumors have been circulating for quite some time. Early on Thursday 22 September, IntraFish published an article, titled: “Postponed auctions fuel new speculation about resource rent tax.”

Why were the auctions for new salmon capacity postponed by 15 days, until the week after the proposal for the state budget is presented?” asked the two journalists rhetorically, pointing out that the previous Friday, the Norwegian Ministry of Trade and Fisheries published a short notice on its website that the ministry was postponing the auction for new farming licences.

Originally, the auction was to have been held on 27 September. Now it was postponed until 10 October.

The Støre government will also present its proposal for the state budget for 2023 on 6 October.

Likely

The next day, Friday 23 September, SalmonBusiness followed up with an article based on a note from Carnegie analyst Philip Scrase. He delved into the same matter:

“We have not found any other good reasons for the government postponing the auction at such short notice, other than the potential need to publish new and relevant information. Thus, we see it as quite likely that increased taxation will enter the budget, and will be careful with trading the Norwegian salmon farming shares until 6 October,” said the note from Scrase.

Throughout the weekend, and into the next week, the debate about basic rent for salmon farming raged on social media. The topic has not been aired to any great extent after a proposal for the same was voted down in the previous Storting term. Suddenly it has become a hot topic.

In the print editions on Tuesday morning, 27 September, both VG and DN wrote editorials, in laudatory terms, about the introduction of a possible resource rent tax for the fish farming industry.

“The conservative government rejected the tax. But now the chance is here. Yes, it is really quite unbelievable that the salmon tax has not been introduced long ago,” wrote VG.

“The time has come for basic rent taxation of salmon farming,” DN concluded.

Leaks

Someone had been talking. But who knew what when?

Leaks are normal, but not of stock-exchange-sensitive information. It is also not legal to spread so-called inside information. According to Finanstilsynet, the Norwegian version of the SEC, the definition of inside information is based on four main criteria. These require that it must be about information:

· that is precise

· which has not been published

· which directly or indirectly relates to one or more issuers or one or more financial instruments, and

· which is apt to noticeably affect the price of the financial instruments or associated financial derivatives if the information is made public.

Share prices for the salmon companies have fallen steadily over the past ten days. Many investors have used the days to get rid of salmon stocks. Did any of them have precise inside information?

Stock-market sensitive

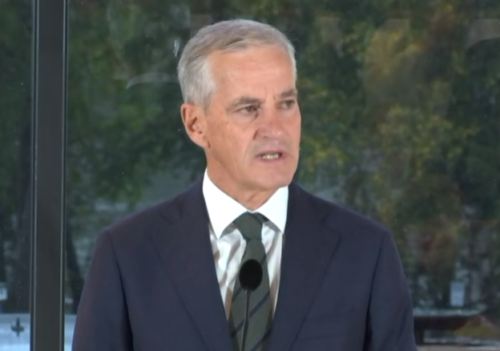

A little later in the day, on Tuesday 27 September, Prime Minister Jonas Gahr Støre and Finance Minister Trygve Slagsvold Vedum were urgently calling for a press conference. The place where the press conference was to be held, Blaafarveværket in Åmot, was not so unusual. What was unusual was the timing: Wednesday 28 September at 08:30. It was unusually early – half an hour before the stock market opens.

Everything indicated that it was stock-exchange-sensitive information. However, Oslo Børs was still open for trading when the notice about the press conference was sent out.

The ban on insider trading is central to securities law. Insider trading is characterized by obtaining an unjustified advantage from inside information to the detriment of third parties who are unaware of the information. This could undermine the market’s integrity and investor confidence.

Illegal

What many of the regulations have in common is that they are linked to whether information constitutes inside information, including, for example, the ban on trading, the ban on illegal dissemination and the duty to publish inside information, as well as the obligation to keep a list.

Inside information means information about matters relating to an issuer or one or more financial instruments, which is not known or available to the public, and which a generally prudent investor would probably take into account when assessing whether the person in question should buy or sell related financial instruments. The current definition of inside information is largely a continuation of the previous definition in MAD, in addition to the codification of case law from the EU Court of Justice.

$5.2 billion

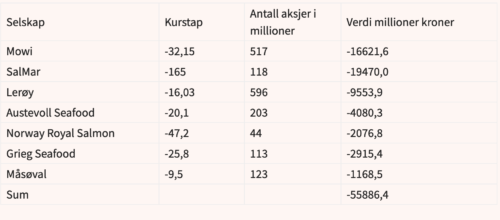

On Wednesday 28 September, after the government had finally officially released the information about a proposed ground rent tax of a whopping 40 percent, share prices were devastated. During the day, an incredible NOK 55.9 billion (USD 5.2 billion) in stock market value was wiped out.

It was brutal. A fall that has no equal in the decades one has been able to trade salmon shares on the Oslo Stockexchange.

Those investors who have unloaded their salmon shares in the past week could breathe a sigh of relief. Those investors who had short-sold salmon shares, and speculated on a fall in price, could now cover their shorts – and rake in big profits.

SalmonBusiness has contacted Oslo Børs’ communications manager Cathrine Lorvik Segerlund for comment on this matter.