On Monday morning it became known that Mowi would be entering the frey in the battle to secure control of fish farming company NTS. The Mowi bid values NTS at NOK 110 per share, with 50/50 settlement in cash and Mowi shares.

Read also: Mowi bid offers prospect of 600,000 tonne colossus

Carl-Emil Kjølås Johannessen thinks the valuation of the takeover bid on NTS looks favourable.

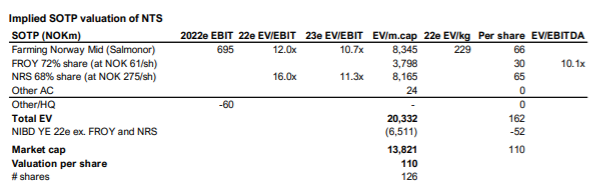

“The bid requires an acceptance of more than 50% of the shares on a fully diluted basis. At NOK 110/sh we would argue that the salmon farming operations in NTS is valued at around 11x 23e EBIT, fairly in line with current valuation of Mowi. It should also be some synergies by combining the operations. Potential higher valuation Frøy (e.g in sales process) could also lead to lower implied farming multiples. We would argue that farming operations has a good fit with Mowi, and if they are able to buy the company at current valuation, we see it as a positive.” wrote Kjølås Johannessen in a note to Pareto’s customers after the transaction became known.

Kjølås Johannessen has also outlined a calculation, with implied sum of the parts (break-up value – editor’s note) by NTS.