Last week I came across a brand new analysis of Goldman Sachs. It showed the stock inventory for aluminum every year for the last decade. This year’s entry was very noteworthy; stocks were unusually low. Furthermore, it was noted that aluminum prices were at historically high levels. The punchline of the analysis, however, was this: This does not only apply to aluminum – this applies to virtually any metal at present.

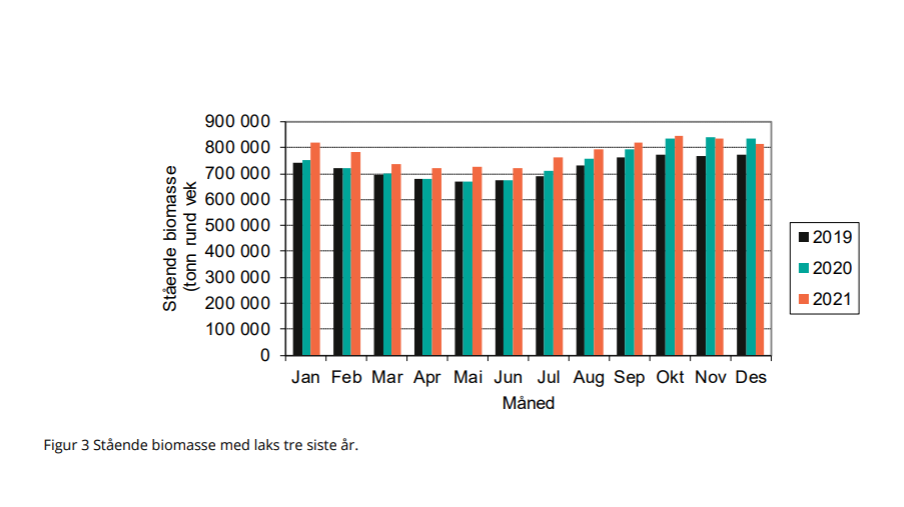

My first thought was that the graph showing the aluminum stocks then seemed to be astonishingly similar to the graphs for salmon biomass. Here, too, there is a negative development at the beginning of the year. Less fish to harvest. In a market that is screaming for supplies in line with the reopening of the world market post Covid-19.

Imbalance

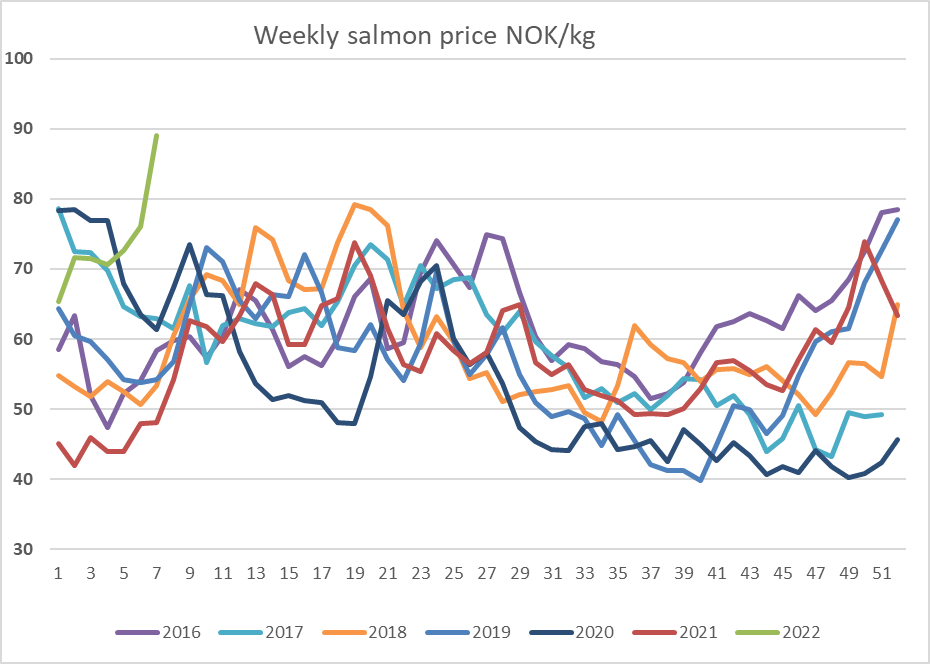

A clear imbalance between supply and demand. One need hardly add that the spot price this week is the highest recorded in recent times.

Also read: “I have never bought at such high prices in my life. Never.”

But what does this inventory reduction mean for the aquaculture industry?

The risk now is whether the fish farmers, perhaps especially the smaller players, will be tempted to harvest their small fish. By accelerating the harvesting plans, it will already be possible to ensure a very good annual result. The catch is that this can further worsen the market balance. This means that there are fewer fish to feed for later sale. Prices could shoot even higher.

With an operating margin that is currently around 50 per cent for the average fish farmer, the free cash flow is very spacious.

Ripple effects

The odds are low that the farmers, as a direct consequence of this, may be tempted to increase their investment budgets: Do we need a new work boat, smolt tank, cages or feed raft? Or maybe even a new land-based fish farm?

And also in recruitment. You need sufficient competent manpower to take part in the ongoing party. With that comes wage pressure.

In such a market, supplier companies can now position themselves for a landslide of contracts. Here one can not afford to neglect the opportunities. One must reach the customers, as many of them as possible, with communication – to sell the goods. This in turn requires visibility and increased sales and marketing budgets. This is not where one should save money now.

And so the ripple effects spread in the water.