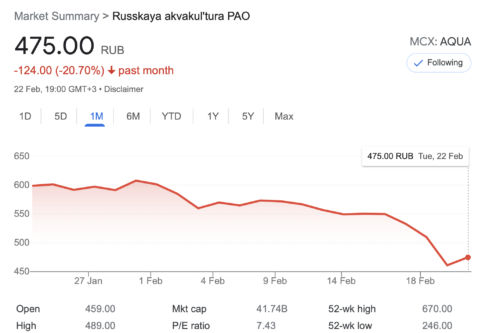

Shares in Russia’s largest salmon producer, Russian Aquaculture, have taken a dive in the past month as 20 per cent of their value has been wiped out.

European markets were a sea of red on Tuesday following Russia’s unilateral decision to recognise two breakaway republics in the east of Ukraine, Luhansk and Donetsk.

The move by Vladimir Putin shattered hopes of a diplomatic resolution to the worsening situation on Europe’s eastern flank and sent politicians across Europe and the US into a spin as they attempt to coordinate sanctions against the Russian regime.

Aquaculture companies were not exempt from the stock market bloodletting which saw Russian Aqaucuture shares crash to a low of RUB 396 before staging a modest recovery as only initial modest sanctions were announced.

Britain imposed sanctions on five Russian banks and three billionaires but stopped short of targeting major lenders, such as state-controlled Sberbank and VTB, causing the rouble to rebound and seeing Russian shares recover some of their losses.

Russian Aquaculture, which farms Atlantic salmon and trout in the Murmansk and Karelia regions, and has plans to build up volumes of harvested fish to 35,000 tonnes by 2025. Will these plans be disrupted?

With year on year revenue growth of 73 per cent for the nine months to 30 September 2021 driven largely by domestic demand, and an EBITDA of RUB 3.9 billion (€47 million), up 52 per cent year-on-year, its seems for now that the company will be able to weather the storm.

Read more: Strong Q3 results for Russian Aquaculture on back of HoReCa recovery

Russian Aquaculture currently owns cultivation rights for 39 sites for farming salmon and rainbow trout. The total potential production volume for these sites is around 50,000 tonnes of salmonids.