There is no going back. Here come the land-based fish farms.

It is starting to materialize now. In the last week alone, we have seen a large number of tangible examples:

An ex-researcher has been given the green light for a RAS facility in Lyngdal . In the New Year, after many years of struggle, Salmo Terra will finally be able to stick the shovel in the ground for its facility in Øygarden. While Artec Aqua owner Endúr has landed a contract for €44 million.

Meanwhile, Norway’s state administrator has given the green light to the 24,000-tonne Baring Farsund. Awilco has bought over ten percent of BioFish. And Hjelvik Matfisk will harvest fish from its brand new land-based facility this spring. Arctic Seafarm Langset has been granted a discharge permit for its facility at Nesna.

An entirely new sector is emerging. A sector that will raise salmon on land.

2.5 million tonnes

SalmonBusiness has brought to light 109 different companies with far-reaching plans to farm salmon on land. The plans are to be realised in 21 different countries. These have a total theoretical production capacity of 2.5 million tonnes. In comparison, the world’s salmon production, from cages in the sea, is 2.7 million tonnes in 2021.

Not all onshore facilities will be realized, primarily due to lack of funding, but many of them will be.

Check out iLaks / SalmonBusiness’ industry report on land-based salmon HERE

And in the same way as at sea, there are no nations that want to produce more salmon on land than Norway. Just under one million tonnes are planned in the country.

Area battle

These facilities will not be listed without a dispute.

At Fleinvær, just outside Bodø in Norway, Gigante Salmon faces challenges and resistance. Local forces fear a coastline with blasted islets. At Toft, by Brønnøysund, Aquaculture Innovation strives to convince the local population that their facility will enrich the region.

Critical voices claim that the struggle to secure land for the large land-based fish farms will combine with local opposition to wind turbines.

Capital

Production of salmon on land is both capital and energy intensive. Excellent for the market for both debt and equity. Especially the latter. The banks have, with the support of their own risk assessments, taken a wait-and-see attitude.

The big capital has long since signed up. On the Oslo Stock Exchange alone are seven different companies are listed that operate salmon farms on land. And there are more knocking at the door, eager to enter.

Admittedly, it should be immediately added that not all of these have risen in value.

Danish exercise

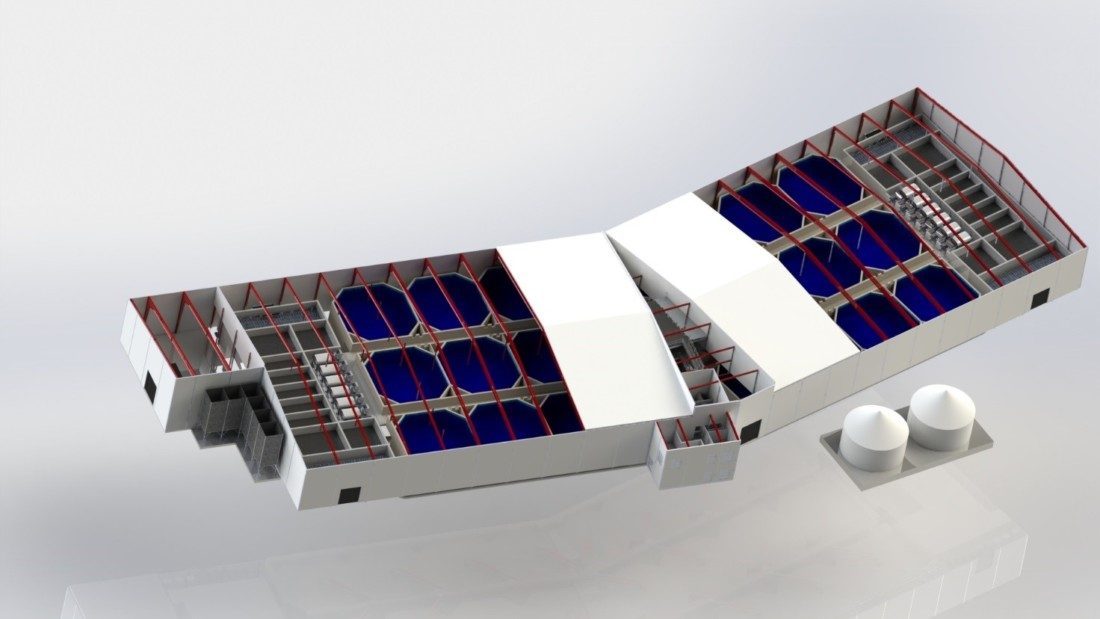

The production technologies, sea cages versus salmon factories on land, are vastly different. And with that, a completely new supplier industry is also growing together with the new breeders. This was visible at this year’s AquaNor trade fair, where a rich array of manufacturers of vessels, pipes, pumps and gaskets were all in place to promote their products.

Many of them had Danish passports. After developing land-based farming over several decades, Danish engineers are now in the middle of their commercial breakthrough.

There is room for more. In a market characterized by strong growth in demand, at the same time as the authorities are lukewarm about growth in coastal farming in open cages, consumers are opening their wallets to get their sushi.

And they won’t necessarily be asking if the salmon has swum in the sea or if it has grown up in a factory.